An Alleged Pump-and-Dump Company and its Natural Sweetener, Part I

One of my readers recently inquired about a natural sweetener called SUSTA.

I took a look at it, and of course I was immediately skeptical of the product when looking at the manufacturer's claims and then also looking at the ingredients.

However, that's not what jumped out to me the most. I saw the name of the company...NXT Nutritionals.

NXT Nutritionals...man, that sounds familiar. Where have I heard that before?

Wait, I know! I've traded their stock before, which goes under the ticker symbol NXTH.

Of course, the fact that I've traded the stock is not necessarily an interesting story in and of itself. However, the reason why I traded this stock is what is interesting. To understand why I traded this stock, I need to give you some background first.

Trader By Morning, Weightologist By Night

Many of you may not know that I trade stocks part time, and I have a trading blog (which I don't regularly update anymore, although I hope to start up again in the future). One particular trading strategy that I have found to be very effective is to find stocks that have run up in price very quickly (such as 80-200% within days) based on purely hype, and then short them. For those of you not familiar with the world of finance and trading, shorting a stock means that you borrow the stock from your broker, and then sell it, with the hopes of buying it back later at a lower price. You then profit from the difference. Most people are familiar with buying low and then trying to sell high. Shorting is the opposite...you sell high first, and then try to buy low later. I have often made 10-30% returns on a single trade using this strategy.

The Anatomy of a Pump and Dump

One sub-strategy of the strategy I mentioned above is to find pump and dumps, and then short them. This is a strategy that I have learned from a trader named Tim Sykes, who specializes in identifying and shorting pump and dumps. I have made some excellent returns using this strategy; in fact, on one trade, I made a nearly 100% return when I shorted the pump and dump Genova Biotherapeutics (GVBP) at 37 cents and covered at 3 cents when the Securities and Exchange Commission (SEC) stepped in and investigated them.

Here is the way a pump-and-dump scheme works. The people behind the scheme will accumulate shares of a stock at a very low price. They will then artificially inflate the price of the stock by putting out false or misleading statements (i.e., "pumping" the stock). Typically this is done through email spam campaigns and messages in chat rooms and message boards. Often, you will see claims that a stock will double, triple and quadruple in price. The stock promoter who is promoting the stock will often claim to have inside information about impending news. Newsletters will be put out, claiming that the stock is hot and that you need to buy it.

Investors, believing the hype, begin to purchase the stock. The stock price then starts to rise. Other investors and traders also notice the rising price, and jump on the bandwagon, buying more stock. This pushes the stock price even higher. However, what the investors don't know is that the insiders and people behind the scheme are selling their shares as the price rises, profiting handsomely off the rising stock price. Eventually, the insiders run out of shares to sell, and the pumping stops. Now there is nothing to hold the stock price up, and the stock crashes in price (the "dump"). The investors who bought into the scheme lose their investment.

Pump-and-dumps are most prevalent among penny stocks, namely stocks trading on the Over-The-Counter-Bulletin-Board (OTCBB) and Pink Sheet exchanges. You usually find them more frequently on these exchanges because the stocks are easily manipulated since there is little or no independent information available about the company. You can find pump-and-dump schemes on other exchanges as well, such as the NASDAQ, but they are not as common. In fact, Enron is probably the most famous example of an elaborate pump-and-dump scheme, and it traded on the New York Stock Exchange (NYSE).

It is the very nature of the pump-and-dump scheme that makes shorting them so profitable. Since the stock price is artificially inflated, it is bound to fall in price (often drastically). By shorting just when the dump starts to happen, you can capitalize on the rapid fall in price. The difficulties with this strategy, however, are that it is not scalable (you usually can't take big positions), it requires a fair amount of capital to short a penny stock, and often it is very difficult (if not impossible) to find borrows from your broker.

Identifying Pump-and-Dumps

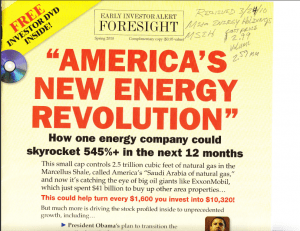

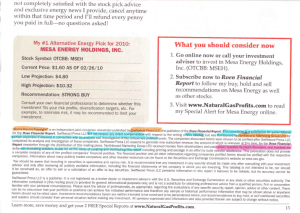

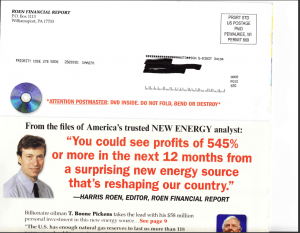

Email and direct mail spam campaigns are a frequent method used by stock promoters to pump a stock price. Here are some examples of some direct mailers, pumping the stock Mesa Energy Holdings (MSEH) (click on each one for a larger version):

It's always important to read the fine print in these mailers:

Swiftwood Press, LLC...was reimbursed by Northbound Marketing Group LTD for certain expenses it incurred in connection with its analysis and investigation of the companies profiled herein....Northbound Marketing Group LTD received monies from shareholders and paid seven hundred fourteen thousand, one hundred six dollars to marketing vendors, to pay for all the costs of creating and distributing this report..

This stock promoter was paid $714,106 to pump the stock, and the insiders holding the stock sold 6 million shares into the rising stock price.

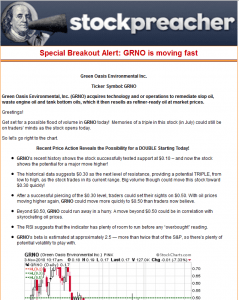

Here's an example of an email spam stock-pumping campaign. This is an email from a known stock promoter Stockpreacher (click on the picture for a larger version):

The bottom of the email has the following disclosure:

This newsletter is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Stockpreacher.com is a wholly-owned subsidiary of BlueWave Advisors.BlueWave Advisors was previously compensated one hundred thousand dollars from Ramos & Ramos Investments, Inc. (a non-controlling third party shareholder) for GRNO advertising and promotional services that have expired. Currently BlueWave Advisors has been compensated fifty five thousand dollars from Ramos and Ramos Investments Inc. (a non-controlling third party shareholder) for GRNO advertising and promotion. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this newsletter as the basis for any investment decision. BWA does not hold a position in the covered company.

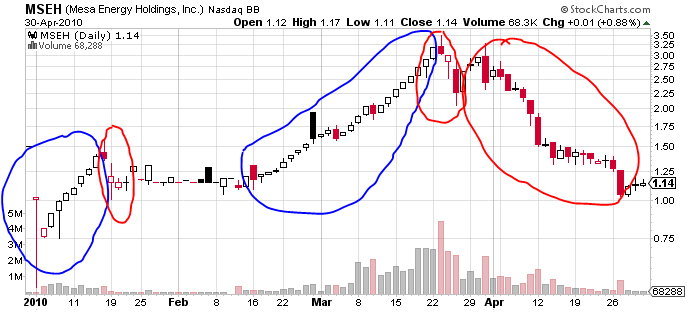

Pump-and-dump schemes can also be identified purely by a stock's price chart. Stocks being pumped through mail campaigns are often the most easily identified. Here is the chart for MSEH from January through April, 2010. The price action shows that this stock is slowly being manipulated upwards through a stock mailing campaign. Notice the day-by-day "stair-step" action of the price (circled in blue); this is the classic day-to-day price action of a mailer pump-and-dump scheme. Notice the rapid fall in stock price during the dumps (circled in red).

The stock chart for Mesa Energy Holdings (MSEH), a stock involved in an alleged pump-and-dump scheme from January to April. The days circled in blue represent the "pump", where the stock price is slowly controlled and manipulated up. Investors buy into the pumping, and the insiders are selling their shares. The days circled in red are the "dump" phases. There is nothing holding the stock price up, so it falls rapidly, losing 30-50% of its value within a few days.

So where is MSEH now in price? It's now trading at 15 cents per share, despite the fact that the pumpers claimed that it would go anywhere from $4 to $10 per share.

It is estimated on average that investors who buy stocks pumped up through mailers lose 5.5% of their investment, and pumpers profit an average of 4%.

So what's all this got to do with NXT Nutritionals and their natural sweetener? Click here to read Part II and find out.

Disclosure: I am Tim Sykes affiliate and I receive a commission for products purchased through my affiliate link. While I am no longer a subscriber to his services, I have used his products in the past and they have been instrumental in helping me become a more profitable trader. I do not currently hold any position in NXTH.

Great article James,

I am also extremely interested in investing and love how you mix it with nutrition in this article. I meant to ask you in our interview, what do you think of Cweet?

http://www.cweet.com/

Thanks and keep up the great work,

-Armi

Interesting, looking forward to reading how this relates to the sweetener..

Btw; any thoughts on the sweetener Stevia? I really like the taste, and based upon what I’ve read about, it seems to be probably the safest sweetener there is.. (not that I’m ‘afraid’ of other sweeteners).

I used to be a bit skeptical of Stevia due to the lack of safety data on it at the time, but there’s more and more safety data coming out. Thus, it does appear to be safe.